Finding ways to reduce costs is essential for any business. Not least in these trying terms under the shadow of the COVID-19 (new coronavirus) outbreak. A good way of doing so – for when your fleet of vehicles are on the road – is by using a mileage report.

Generally, cutting costs may come by many different forms of action. It also requires careful management of all business resources. Whether it’s electrical bills, payroll, office space rent, insurance costs – the list goes on.

In vehicle management, cost savings can come via careful consideration of ways to get tax exemption — which you may already be eligible for. How about submitting your detailed, (hopefully) valid and lengthy mileage report for deductible expenses?

We know, it’s not rocket science, but it’s surprising how many companies may pass this by.

Don’t forget your deductible expenses and mileage report

The whole vehicle deductible expenses topic is not just about your business’ fuel and mileage expenses. As we’ve previously discussed on this blog, there are many different types of deductible vehicle expenses you can claim for your business.

In particular, for contractors, we have also outlined a rough idea on how mileage deduction works and the deductible journeys you can claim. We’ve also provided tips on methods that tell you how restricted mileage can lower your insurance rates.

This time, we’ll turn our focus on a more official, or bureaucratic aspect of your business. And it’s one that Veturilo, vehicle management for small and medium-sized businesses, can make your life easier with.

A glimpse at vehicle tracking

As you may already know, Veturilo can give a comprehensive overview of your vehicles’ trips. This is important for two reasons. Firstly, because logging your trips is vital for compliance and safety reasons. But it can also help you identify areas where you can be more efficient.

And all that information is available to you, at any time, right there on your cell phone.You can get a glimpse of where your vehicles have been this last day, last week or last month with all the required details: starting point, destination, duration, total miles. You can indicate whether the trip was personal or professional, together with the respective route view on the map. All pertinent incidents will be marked on the respective routes on the map. Driving behaviors such as fast accelerations, sharp turns, hard braking etc, are included, among other indicators. That should be enough for a brief inspection from your phone.

The mileage report

But, what about that mileage report we’ve being banging on about? Well, gathering all your mileage data for all of your business vehicles may be a daunting task. And there are some pitfalls involved. Like these…

- You might forget to do it in good time: even one month of forgetfulness will cause you quite a headache

- You might do it sloppily and fail to get all the essential details

- Last but not least, you might end up investing much more time than needed to this rather tedious task, which can distract you from other, more crucial aspects of your business

How about having all the data exported to an Excel file? An excel mileage log if you like, ready for you to send it to your accountant or submit it, to claim your deductible travel expenses? Well, that’s the meaty part of the mileage report (or excel mileage log, to be more accurate) functionality in Veturilo.

Why do I need to track deductible miles?

To be honest, that’s just a rhetorical question. According to IRS regulations, in order for you to claim your deductible travel expenses, you need to submit a record of trip data. However, you are not obliged by the law (or IRS regulation) to strictly have your odometer’s readings included in the report. That means you may even have to provide an old-fashioned paper mileage log, written by hand. Just think how much time you’d save if you automated this process for all your vehicles! Wouldn’t it better to automate all of this, in terms of logging and forwarding all pertinent information to the proper recipient? If you’re wondering what the answer is, it’s yes!

How does Veturilo help me automate the whole process?

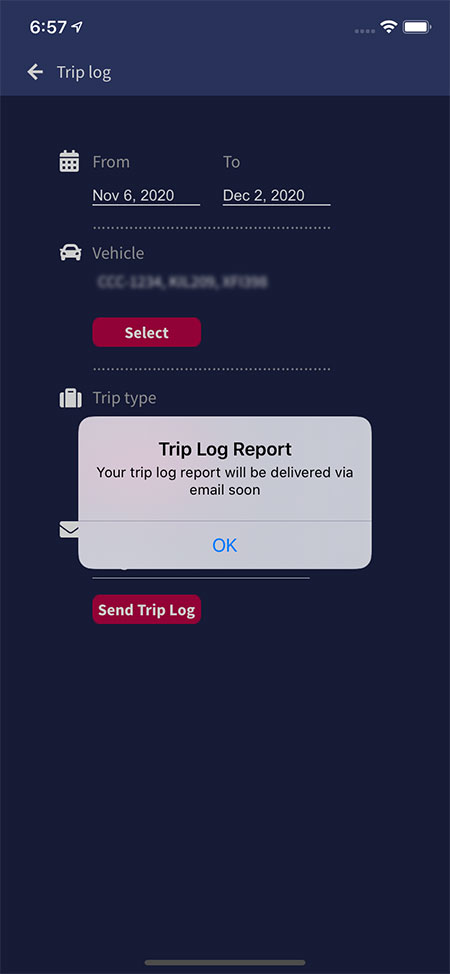

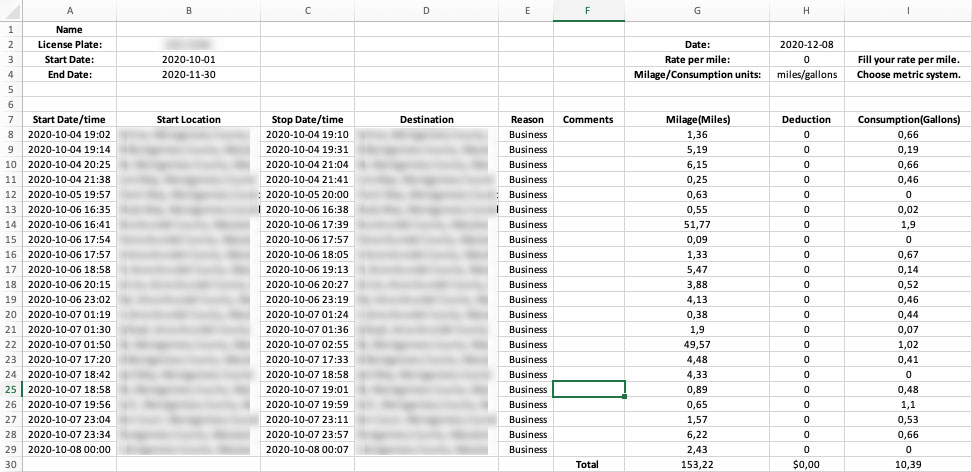

You can use the mileage report (or trip log) feature that comes with Veturilo. Get all trip log data (in the form defined by IRS regulation, with all mandatory fields) straight to your own or your accountant’s email inbox. All you have to do is to fill in the email address [make sure you got it right from them] in the form available with the trip log report feature in your mobile app. This is the data you’ll be getting:

- Starting point, and destination location for every trip

- Start date & time and stop date & time for every trip (if you shut off the engine for more than a few minutes, you get a new trip started the next time you start your engine)

- Type of trip: personal or business

- Total miles covered during each trip

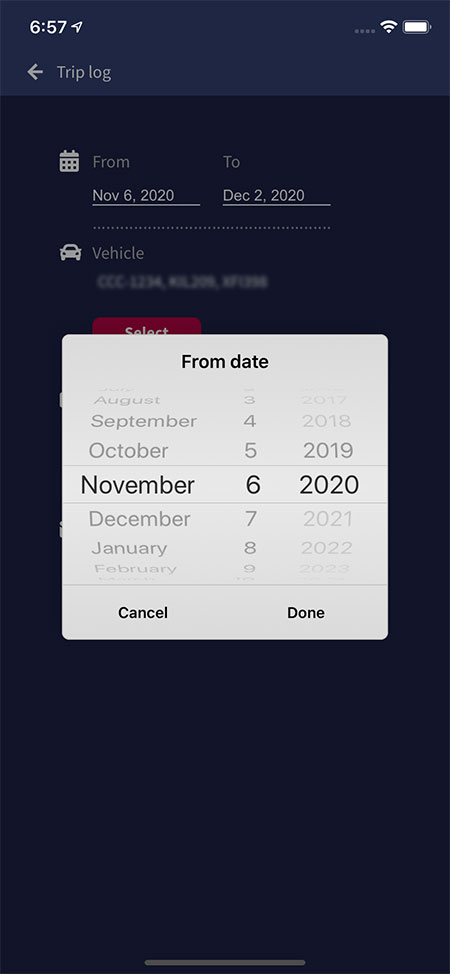

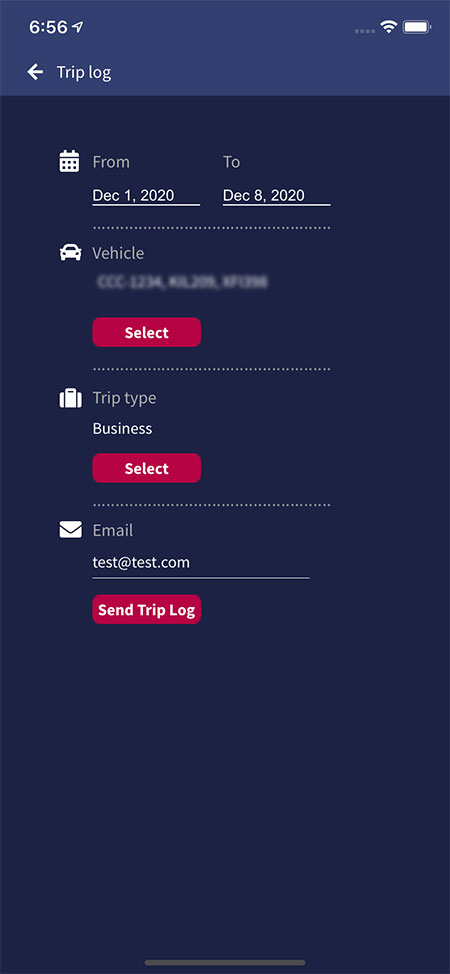

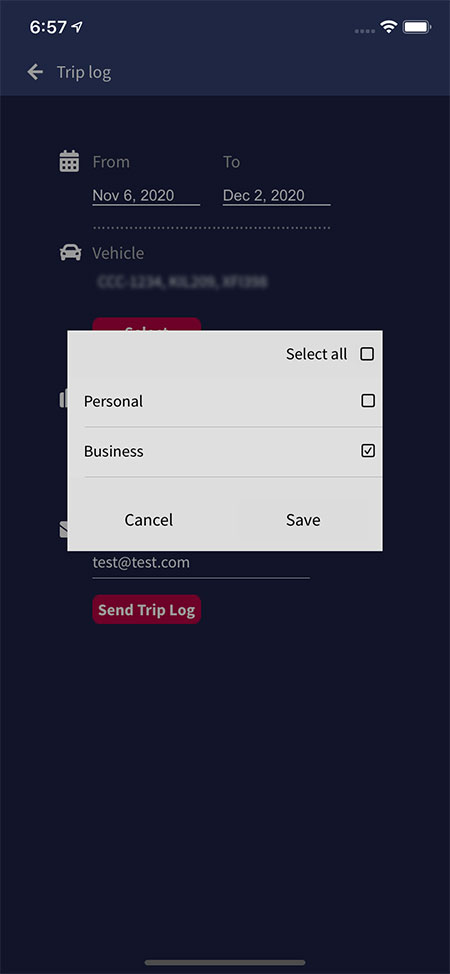

To give you a better idea how easy it is to create a mileage report using Veturilo, you just need to insert:

1. The date range you want the trip log to include

2. The vehicles you want in the report

3. The trip type: personal or business

4. The email address you want the report to be sent to

All this information is available separately for each one of your vehicles (you get a separate excel sheet per vehicle). The report is ready for you or your accountant to fill in the rate per mile and calculate the total deductible amount for all your entire fleet.

Here’s a quick look at the report and how it looks like on the spreadsheet:

Wait, there’s more…

Far be it from us to repeat ourselves, once more. But additional functionality will add up to make your business better, ever producing new opportunities. With Veturilo you’ll be the first to benefit from features such as push notifications, and many more.

Keen to try it out? Contact us and get started today. There’s nothing to lose as if you don’t like the service, you can return the device within 30 days and get a full refund.